His name isn’t James, and he hasn’t officially been stung. But this is based on a real person; he has approved us to talk about his particular situation. Names have been changed to protect him from pension advisors.

“James” has worked for a very big British company for over 30 years. After moving to the UAE some years ago, his pension fund reached maturity, and at the grand old age of 55, his pension was able to be paid out. As the pension was being paid, he noticed that PAYE was being deducted from his drawings. He completed the P85, which was accepted, accepting his non-dom status. The lovely people at HMRC were deducting 48% in tax. To get that money back, he now has to provide information based on his domicile status again. Part of that process is to obtain a tax residency certificate from the Federal tax authority.

Navigating Double Taxation and Tax Certificates with Relocate MENA: Your Expert Guide

When moving across borders, individuals and corporations often face the daunting prospect of double taxation. This can significantly impact your financial planning and the overall cost of relocation. At Relocate MENA, we understand the complexities of international tax laws and the challenges they pose. Our team of internal tax agents is dedicated to supporting our clients through every step of their relocation journey, ensuring a seamless transition with optimized tax obligations.

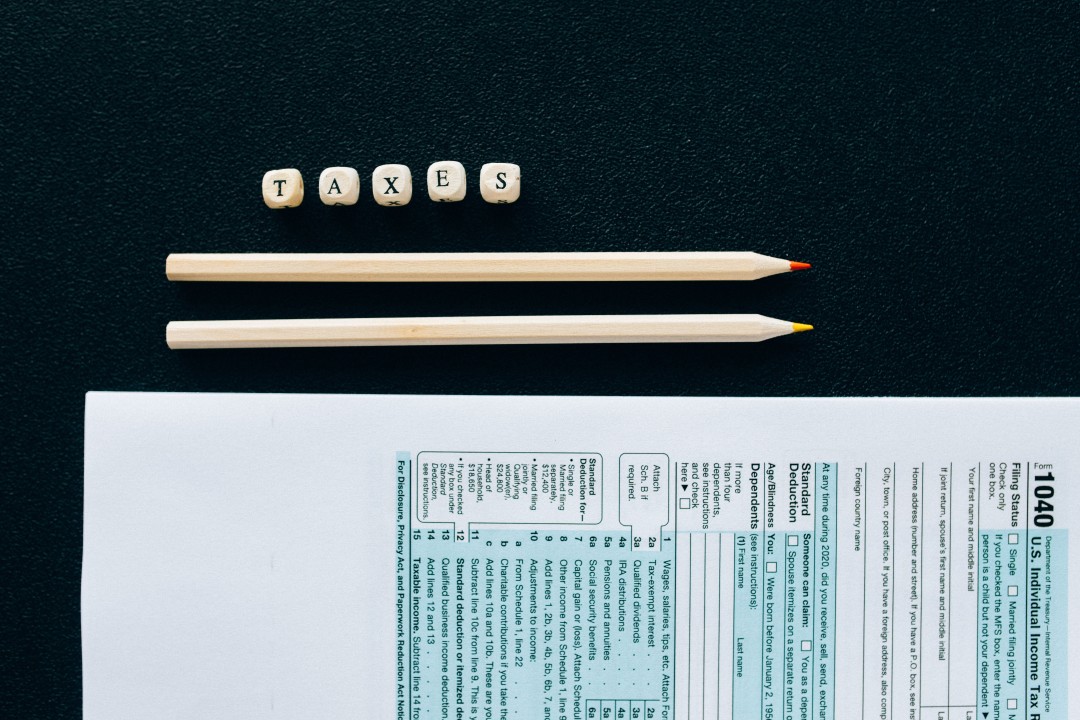

Understanding Double Taxation

Double taxation occurs when the same income is taxed by two or more jurisdictions. This situation is common for expatriates and international businesses, potentially leading to a higher tax burden. However, with strategic planning and the right support, it’s possible to mitigate these effects and ensure compliance with all relevant tax regulations.

How Relocate MENA Can Help

Our in-house team of tax agents specializes in the intricacies of international tax laws, including double taxation agreements (DTAs) and tax treaties. We provide personalized advice to minimize your tax liabilities while ensuring compliance with the laws of both your home country and the UAE. Here’s how we can assist:

- Tax Consultation

We begin with a thorough assessment of your situation to understand your specific needs and objectives. Our experts then craft tailored strategies to navigate double taxation effectively.

- Tax Certificate Assistance

Obtaining a Tax Residency Certificate (TRC) from the Federal Tax Authority (FTA) in the UAE is a crucial step for individuals and companies seeking to benefit from DTAs. Our team guides you through the application process, ensuring that all requirements are met efficiently and accurately.

- Compliance and Optimization

Beyond securing tax certificates, we help you understand your tax obligations in both jurisdictions. We aim to optimize your tax position while maintaining full compliance with all legal requirements.

- Continuous Support

Tax laws and treaties can change, and so can your personal or business situation. Relocate MENA offers ongoing support to address any tax-related challenges that may arise during and after your relocation.

Why Choose to talk to Relocate MENA?

- Expertise

With over 40 years of combined experience in the relocation industry and a specialized focus on tax consultation, our team is uniquely qualified to support your needs.

- Personalized Service

We understand that every client’s situation is unique. Our approach is tailored to meet your specific circumstances and goals.

- Comprehensive Solutions

From arranging the survey of your household goods to managing door-to-door relocation services, we offer a complete suite of services to make your move as smooth as possible.

- Technology-Driven

Our innovative software platform, Relo-Global.com, provides real-time status updates, ensuring transparency and peace of mind throughout the relocation process.

Navigating the complexities of double taxation and securing tax certificates from the FTA can be challenging. With Relocate MENA, you have a partner who not only understands these challenges but also possesses the expertise and resources to overcome them. Our team of internal tax agents is here to ensure that your relocation is not just about moving to a new place but also about making smart financial decisions along the way.

For more information on how we can assist with your relocation and tax planning needs, visit our website or contact us directly. Let Relocate MENA be your guide to a successful, tax-optimized move.

It’s a document that proves your tax status in a new country, crucial for avoiding double taxation.

Yes, without proper planning and understanding of tax laws, you might face unexpected tax deductions.

Obtaining professional advice and a Tax Residency Certificate can mitigate risks.

They provide guidance on international tax laws and help optimize tax obligations.

To avoid financial losses like unexpected tax deductions and ensure a smooth transition to your new country.